Wise Vs Revolut: Which Is Better In 2024? [Detailed & Unbiased]

One of the top tips I can give you while travelling is to invest in a great travel card - trust me you won’t regret it!

There are plenty to choose from, but this guide is going to dive into the similarities and key differences between Wise and Revolut.

We started using Revolut back in 2016 on our backpacking trip around South America, and we’ve used Wise since early 2019 so we’ve got a few years of experience with both...

To give you a good idea of which travel card is most suited to you, I’m going to go through the pros and cons of each for both personal and business accounts.

So, let’s get stuck in…

Great features of Wise for travel

First of all, let’s take a look at Wise and the features that benefit us travellers so much…

- Although not travel-specific, Wise is FREE to sign up for and there are no monthly fees

- You can hold money in 50+ currencies and convert between them for the real exchange rate

- With Wise, you can withdraw up to 200 GBP per month from international ATMs for FREE

- You can use the Wise debit card abroad like you would any other debit card

- You can freeze your card if it gets lost or stolen

- Low transfer fees

- Better exchange rate than many other platforms out there

- Wise is great for receiving payments in foreign currencies and then offering great exchange rates and low fees to convert to pounds

- Available in over 60 countries, and your card will be shipped out for you (for a fee)

- Wise offers virtual cards as well as plastic ones

Wise Business

Now, let’s take a look at the benefits of opening a Wise Business account!

Of course, this is tailored specifically towards individuals who are self-employed but if you’re a keen traveller and a digital nomad then it’s likely that you may fall under this bracket.

With a Wise Business account, you’ll have many benefits of business banking but without any hidden charges, monthly fees, or high rates.

So, what are these benefits?

Key Features of a Wise Business account

- International invoices can be paid in one click with a real (and live) exchange rate

- Charges regarding payments can be up to 19x cheaper than the likes of Paypal

- Quick payments - 50% of payments are instant or arrive within the hour

- You can easily make batch payments in just one click (up to 1,000 people)

- Money can be moved between currencies in seconds, avoiding high conversion fees

- Your Wise Business account can be connected with other platforms like Xero

The best part about having a Wise Business account is that they’re very affordable.

For those who are in the EEA or UK, there's one-off set-up fee of £45 (50 euros).

The price of this one-off fee will differ depending on where you're from (and where the business is registered), but typically you'll be paying between £16-£42. With some countries, it does cost more to verify your account so you may be charged a higher fee.

After that, you don't need to worry about any hidden or monthly fees which is a huge bonus, and you'll benefit from low transfer fees and high exchange rates.

Many business owners or freelancers tend to use the likes of PayPal, but as I’ve just mentioned transfers with Wise can save you a lot of money! Trust me, if you’re using PayPal the charges add up over the year…

However, Revolut has some fantastic features too so let’s take a look at them next...

Great features of Revolut for travel

Here’s a quick overview of the features that may convince you to choose Revolut as your next travel card…

- Revolut offers the best exchange rate possible

- Travel insurance is included with the paid plans (Premium, Metal, and Ultra plans)

- A clear account overview of all expenses

- Compatible with Google Pay and Apple Pay

- Offers an easy sharing bills feature

- You can freeze your card if it gets lost or stolen

- You’ll be able to receive international payments

- Quick currency conversions

- Some of the paid plans offer FREE airport lounges and a concierge service

- No-fee ATM withdrawals

Additional Revolut features

- The opportunity to get involved with cryptocurrency trading

- A stock trading market

- You can make charitable donations

- With Revolut, you can receive cashback on specific purchases

Revolut Paid features

It’s important to note that Revolut has a wide variety of personal plans, and some of these aren’t free. Therefore, there will be several paid features that won’t be accessible on a free account.

Some of these ‘paid features’ include:

- Personalised Cards

- FREE card delivery

- 24/7 priority customer support

- Daily interest on USD savings

- Higher monthly withdrawal limits

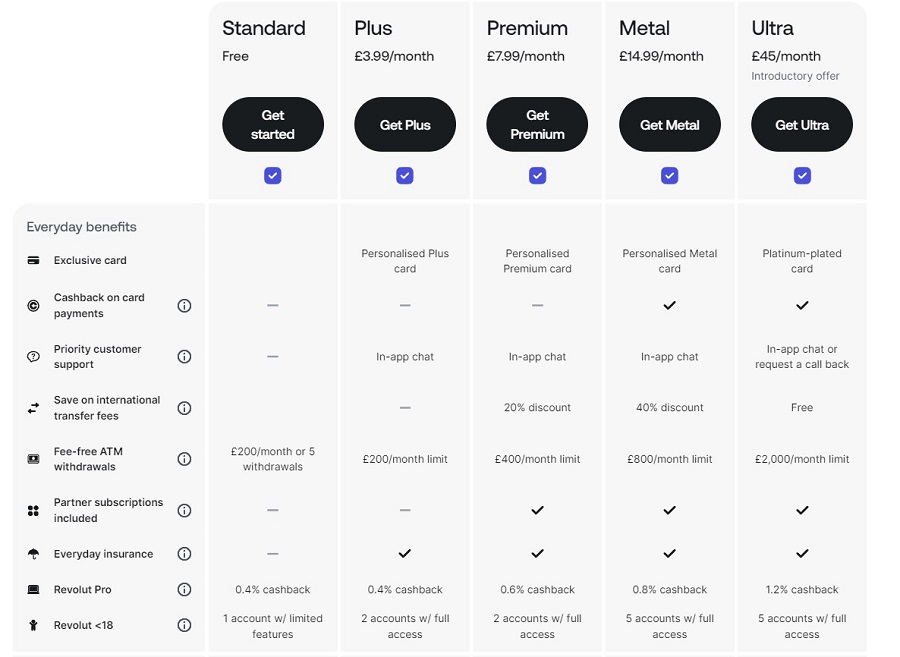

Comparing Revolut personal plans

As you can see there are a variety of personal plans to choose from, so to make things easier I’ve dropped a screenshot of the differences below…

For a more in-depth comparison, I’m going to dive into the Plus, Premium, Metal, and Ultra plans.

The Plus Plan - £3.99 per month

- Personalised Plus Card

- In-app priority customer support

- Two accounts for under 18s with full access

- Up to £1,000 purchase protection for a year on eligible items

- Refund protection that covers you for a full 90 days after purchases

- Ticketed events can be reimbursed up to £1000 if you can't make it due to a reason that's beyond your control (Insurance T&Cs apply)

- Earn up to 2.39% AER/Gross (variable) paid daily on your savings

- International transfers - money can be sent in 29+ currencies

The Premium Plan - £7.99 per month

- Unlimited foreign exchange Monday-Friday

- Up to £400 free international ATM withdrawals per month, and a 2% fee afterwards

- Full purchase protection

- Travel Insurance is included with your monthly fee

- 20% off fees on every international transfer

- Earn up to 3% AER/Gross (variable) paid daily on your savings

- 5 commission-free stock trades every month

- Two accounts for under 18s with full access

- Perks Plus - discounts off top brands

- Benefit from an additional virtual card to help against fraud

- Up to 5% cashback on accommodation

- Access to airport lounges at discounted rates

The Metal Plan - £14.99 per month

All the standard benefits plus…

- Up to £800 free international ATM withdrawals per month, and a 2% fee afterwards

- Full purchase protection

- Earn up to 4% AER/Gross (variable) paid daily on your savings

- 10 commission-free stock trades every month

- 40% off fees on every international transfer

- Up to 10% cashback on accommodation

- Cashback on card payments (up to 0.1% on transactions in Europe and UK, and 1% elsewhere)

- Personal Liability Insurance up to £1 million

- Five accounts for under 18s with full access

The Ultra Plan - £45 per month (the plan I am on!)

With Ultra you get some extra benefits...

- Up to £2000 free international ATM withdrawals per month, and a 2% fee afterwards

- Free International Transfers

- Earn up to 4.75% AER/Gross (variable) paid daily on your savings

- Five accounts for under 18s with full access

- Trip and event cancellation insurance

- Perks worth £4,000+ in annual benefits

- Unlimited lounge access

- Platinum-plated card

- Subscriptions for Sleep Cycle, Headspace, NordVPN, and Picsart

- Can request a call back when it comes to priority customer support

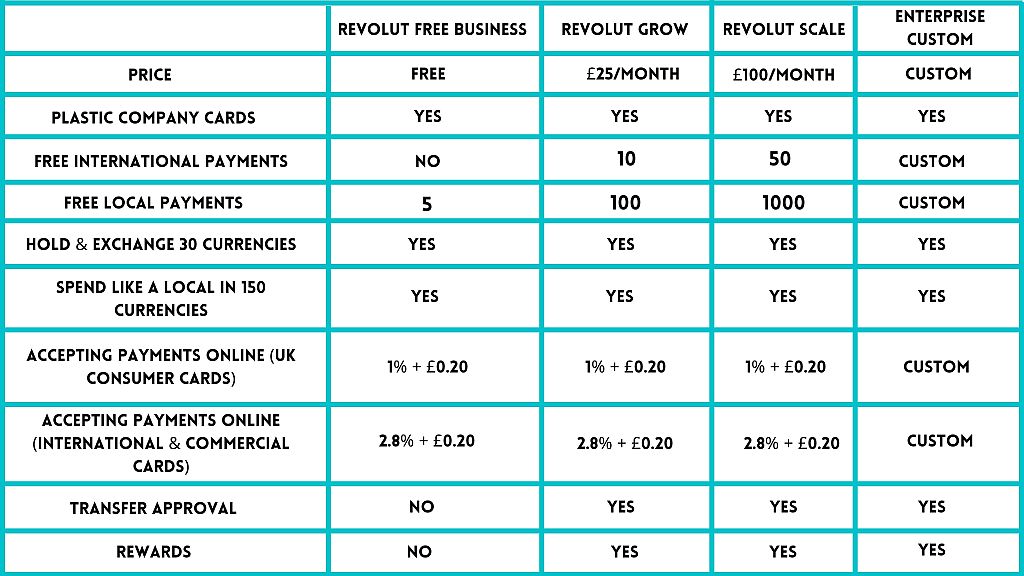

Revolut Business Accounts

Likewise, Revolut also offers business accounts if you’re self-employed or you’re a business owner.

We’ve used Revolut Business since 2021, as we wanted to make sure that we were losing as little as possible on fees once our business started to scale more!

Unlike Wise, Revolut has a variety of business accounts available and some of them are paid accounts.

Comparing Revolut Business Accounts

As well as the benefits included with personal plans, you’ll also get extra if you’ve got a business and opt for a business plan.

There are four types of Revolut business plans and honestly, which one you should choose will all depend on how big your business is, how much money you’re making, and how many international payments you’ll need to make.

Here’s a quick breakdown of the differences between each business plan…

You can find out some of the other differences between Revolut business accounts through their account pricing plans.

What’s great about purchasing a Revolut Business plan is that they’ve evolved their accounts so that you can now receive domestic USD and EURO payments.

Before this, businesses would pay into my Wise account if the payment was in dollars or euros and then I’d have to exchange the currency over to my GBP account in Revolut Business.

Luckily, the process is now much smoother. Now, I can get paid directly from business to the domestic USD & EURO accounts in Revolut Business. This helps you avoid any intermediary fees, although there is a limit on how much you can exchange for free.

You’ll find a couple of other fantastic reasons to upgrade your Revolut Business plan, but this is generally the key reason to do so and the main differentiator in their pricing structure!

If you need to exchange more than, say £10K a month, you can then upgrade your business plan further but just make sure that it makes financial sense to do so first.

Revolut Pro

This platform have also introduced Revolut Pro, an account which is tailored towards freelancers and those with a side hustle. Although relatively new, it's already a great option as there are some brilliant benefits. These include:

- The ability to create, track, and send invoices in seconds

- You can accept in-person payments with Revoluts card reader (transaction fees are 1.5%).

- You can create a QR code or payment link for customers to pay you (transactions fees are 2.5%)

- This account also allows you to receive payments via Apple Pay and digital wallets

- You'll earn cashback on payments used with the Revolut Pro card

- You can make and receive payments in 36 different currencies at an excellent exchange rate

- It's free to open, as you can sign up for standard Revolut account and then set up Revolut Pro through there

What are the key differences between Wise and Revolut?

Now, this is what you’ve all been waiting for…

There are several key differences between Wise and Revolut, so to make this section easier I’m going to split it up into personal accounts and business accounts.

Then later, I’ll dive into the important differences between the companies in more depth…

Comparing Wise personal accounts Vs Revolut personal account

As you can see there are plenty of differences between Wise and Revolut, especially when it comes to personal accounts.

Although Wise and Revolut both offer free plans, Revolut’s paid personal plans offer a lot more flexibility in terms of monthly withdrawals and other features.

However, Wise operates in more countries and you can hold and exchange up to 50 currencies, which is a much higher amount than Revolut.

We’ll dive into a more in-depth comparison of the key differences between the two later on…

Comparing Wise business accounts Vs Revolut business accounts

Although you may not have thought about using Wise or Revolut for a business bank account, both have a lot to offer.

Overall, from a business standpoint, we currently still have both, as there is some nice cohesion there between the two!

However, I’ve definitely started to cut Wise out more and more since the introduction of those domestic USD & EURO accounts with Revolut.

Although that’s the case for me, Wise still stands out greatly in its sheer quantity of different currencies in order to receive payments, which makes its (relatively modest) fees definitely worth the convenience!

Especially as this allows us to cut out PayPal 99% of the time, which is a nightmare when it comes to fees…

Revolut Vs Wise: A breakdown of the key differences…

Both Wise and Revolut have fantastic features, but it’s always important to compare them to see which one comes out on top!

So, let’s take a look at some of the most important features when it comes to travel cards…

1. Withdrawing money from ATMs whilst abroad

Now, this is arguably one of the most important features that a travel card needs to have!

If you’re not careful then withdrawing money from ATMs abroad can cost you a lot in fees, especially in Asian countries such as Thailand.

Both Wise and the Revolut Free accounts allow you to withdraw up to £200 per month at ATMs without fees. However, the paid personal plans with Revolut allow you to withdraw up to £2,000 a month which is a much larger amount (you can withdraw this amount with the Ultra Plan which is what we have).

If you don’t want to pay for this luxury, then you can have a card with both Revolut and Wise, and then this will allow you to withdraw up to £400 without fees.

Due to the monthly limits, Revolut wins this hands down…

2. Foreign currency fees

If you’re planning to receive large foreign payments, then it’s always best to invest in a travel card that will help you save on fees! At the start, we used PayPal and I think we lost around 8-10% of the actual GBP value of our payments which is CRAZY.

After we signed up for Wise in early 2019, we saved so much money due to the great exchange rates and low fees when converting to GBP.

However, after TransferWise was rebranded to Wise in 2022, I’ve found that their fees have increased and they’re not as cheap as they once were!

In fact, we now save more money through Revolut which is the clear winner in this regard!

3. Number of currencies the accounts can hold

Wise is the clear winner when it comes to the number of currencies available!

This is another important factor to think about, especially if you’re a digital nomad or long-term traveller who likes to move around a lot.

Wise allows you to receive and send money abroad from over 50 currencies in total, although some of these transfers can only occur via local transfer.

There’s a full list of currencies on Wise’s website if you’re looking for more information…

Whereas, Revolut allows you to send and receive money from 25+ currencies, which is much lower.

So, if you pick Wise you can hold and exchange over 50 currencies, whilst this is restricted to around 25 with Revolut.

4. Replacing lost cards

One of the best things about using Wise and Revolut is that they both allow you to ‘freeze’ your card if you misplace it or it’s been stolen.

It’s an easy process with both companies as you simply have to head into your account and then go to your ‘manage card’ section.

Both companies will charge you a fee to replace the card of £5. However, if you’re located outside the UK expect to pay a lot more!

Depending on where you live, international delivery can cost upwards of £17.99.

Both Wise and Revolut come out on top for this one so there are no winners…

5. Transfer Fees

Both Wise and Revolut are known for having low transfer fees, especially compared to traditional banks and other platforms such as Paypal.

However, it’s Revolut that takes first place when it comes to fees!

If you’re transferring money to other countries in Europe you won’t encounter any fees, although for international transfers there will be a fee on every transfer - unless you opt for a paid business account.

It’s often a fixed fee which makes it better than Wise’s variable transfer fees, as they are always changing based on market fluctuations.

Wise do have some fixed transfer fees, but even then Revolut offers more bang for your buck. This makes them the best option if you're sending money abroad!

6. Locations where you can open an account

Another key thing to think about when deciding on a travel card is, of course, your location.

Although a company may offer great rates on international money transfers and market exchange rates, it’s useless if it’s not available in your country of origin.

Revolut is only suitable for citizens of the European Economic Area (EEA), the UK, Australia, New Zealand, Singapore, Japan, Brazil, Switzerland, and the United States.

Whereas Wise is available in over 60 countries at the minute. Due to its widespread availability, Wise is the clear winner here, but just make sure your country is included before downloading the app.

These are just a couple of the key differences between Wise and Revolut, so let’s take a look at some of the differences (and similarities) that aren’t travel related…

Other differences between Wise and Revolut that aren’t travel-related

1. User-friendliness

Here’s another key factor to consider when choosing between Wise and Revolut. Whilst abroad, you’re going to want a travel card that’s easy to use!

We’ve been using our standard personal Revolut account since we began travelling in 2016, and throughout the years we’ve watched the app evolve for a better customer experience.

Even though the app has been easy to use from the get-go, today, it’s much more functional. However, Wise is also very easy to use although its app isn’t as popular as the desktop version.

Both of these companies offer a user-friendly experience, although it’s Revolut that has to take the top spot due to the popularity of its app!

2. Customer Support

Customer support is one of the most important factors to consider when choosing a travel card!

Wise is known to offer fantastic customer service with an online help centre and a support team that can be contacted via email, Facebook messenger, phone, Twitter, and Whatsapp.

The one thing to be aware of with the Revolut personal plans is that although you’ll have access to customer support, only the paid plans will have access to 24/7 priority customer support.

The Revolut app offers 24-hour customer service anyway so there will always be someone available if you’re encountering any problems, but the response time will often differ depending on your plan - hence ‘priority support’.

Even with this, Revolut is the winner because they have several live chat options and you can easily talk to the customer service team.

3. Reputation

With a rating of 4.4 on the Google Play Store and 4.9 on the Apple Store, the Revolut app has plenty of excellent reviews. The Revolut Business app also has a rating of 4.6 and 4.8 respectively.

In terms of positive reviews, people have commented on the convenience of virtual cards, being able to split bills, and the wide variety of features.

However, people have left negative reviews regarding problems with customer support, and higher rates on weekends.

Wise has a rating of 4.7 on the Google Play Store and 4.5 on the Apple Store. These ratings are similar to Revolut, and there are plenty of positive reviews regarding smooth transfers and an easy-to-use design.

However, negative reviews have been left regarding the increased transaction fees, app malfunctions, and lack of customer support.

There seems to be pros and cons to both, although Revolut has the higher ratings!

4. Additional Features

In terms of additional features, this is another win that goes to Revolut.

Although Wise has plenty to offer in terms of transfers, banking, and helping to avoid fees, you won't find many other features on this platform.

Revolut, however, has plenty of awesome additional features including stocks, shares, and cryptocurrency. I’ve actually had a play around with these, and they’ve got much better since they’ve been rolled out.

Not only that, but Revolut allows you the ability to set budgets, receive cashback when purchasing certain products, and use ‘saving vaults’.

That’s just a few of the additional features that they offer, and more can be found on their website!

Overall verdict: Wise Vs Revolut - which one is better for travel?

As you can see, Revolut seems to take first place in terms of both travel features and other differences such as user-friendliness and customer support.

Although Wise has plenty to offer regarding availability and currencies, it’s Revolut that stands out to me!

If you’re looking to pay for a personal plan, then Revolut has a lot more to offer than Wise in terms of both banking and travel advantages.

Not only will you benefit from better exchange rates, cheaper transfer fees, and a user-friendly app, but some of their plans offer a free concierge service, airport lounge passes, and travel insurance perks.

You won’t find many other travel cards that offer these kinds of perks, and Wise definitely doesn’t offer anything of the sort either.

Revolut also offers a variety of business accounts, and you can choose your plan accordingly based on the features and what's on offer. Whereas Wise just has the free business account so you won’t have access to as many great benefits.

Another fantastic thing about Revolut is that they offer the ‘pay feature’ which we’ve used a few times to receive payments from brands that don’t want to (or know how to) do an international bank transfer.

This is incredibly handy for brands or companies who’d rather pay for something from us using a traditional credit card payment.

We now have the Ultra Plan and although it's the most expensive paid personal plan, it's certainly worth the price in our opinion as it comes with a ton of awesome perks!

However, Wise has proved very useful on a personal level when it comes to direct debits! For example, during our travels in Canada and America, we were able to set up direct debits for gym memberships and other things.

It is also still a key part of our business when it comes to receiving foreign payments. That being said, now that we have a paid Revolut business account, the markup fees they charge are actually less than Wise's newer, slightly higher commission structure.

As you can see, both these companies have a lot to offer but for me, Revolut easily takes first place! They offer a better user experience, and even with the free personal and business accounts, you’ll benefit from a lot more features.

Not only that, but the Revolut exchange rate is just typically better!

For more information, you can check out our in-depth Revolut guide...

Advice for new users

If you’re planning a trip and you’re not sure which app to download, then I’d recommend going with Revolut.

Whether you stick with their FREE account or you upgrade is totally up to you, but either way, you’ll get access to a ton of awesome features.

However, for the best experience, it may be a good idea to download both Wise and Revolut so you can have a card from each one.

This will allow you to withdraw two lots of money from an ATM so you can avoid fees! Not only that, but you won’t truly know which one will work better for you without trying it yourself…

The future of Wise and Revolut

Although Revolut tips the scale for us, it’s important to state that both of these providers are fantastic in allowing you to handle your finances.

Everyone’s preference is different when it comes to travel cards, and you must make the decision based on what’s best for you rather than just going off our opinion!

At the time of writing, we believe Revolut has more to offer in terms of additional features but this may change in the future…

Companies are always keeping an eye on their competitors, and you might find that to even the playing field, Wise may introduce some more features in the next couple of years.

How to sign up for Wise and Revolut

Signing up for Wise or Revolut is extremely easy! The first step is downloading the app for each one…

From there, you’ll need to enter some basic details like your name, birthday, email address, and home address.

After you’ve signed up you can then request for your card to be sent out to you. Although this will only take a few working days in the UK, you’ll need to allow 2-3 weeks if you live abroad.

Other travel cards to try

This guide is focused on highlighting the differences and similarities between Wise and Revolut, however, there are a couple of other fantastic travel cards out there.

Here are two of the other companies that we’ve tried…

1. Monzo

Monzo is one of the stand-out travel cards on the market with fantastic exchange rates, the ability to apply for an overdraft, and the fact that the cards are compatible with Apple and Google Pay.

We always keep both Monzo and Revolut cards on us, and to be honest there’s no real difference between the two if your sole purpose is to spend abroad and draw out money.

Both have £200 limits on ATM withdrawals (although Monzo has a 3% surcharge fee beyond that), so having one of each allows us to withdraw money with both and avoid charges.

If you want to find out more then you can check out our Monzo Vs Revolut review…

2. Starling Bank

With Starling Bank, you'll have access to 24/7 customer support, be covered by the FSCS, and you can sign up digitally in minutes.

That being said, in all honesty, we’ve never been a big fan of Starling Bank compared to our favourites; Monzo and Revolut.

They don’t offer a ton of additional features, and we found the exchange rate to be slightly worse than some of the other travel cards we’ve used.

We got a card with them because they didn't have a cap on free monthly withdrawals, which is a huge bonus but this bank just didn't work for us.

However, some people really love Starling Bank so it's all about preference I guess!

Wise Vs Revolut? Which one takes the top spot for you…

Choosing the perfect travel card isn’t an easy task when you’ve got to consider their money transfer services, currency exchange rates, and other fees.

I hope this guide has given you a detailed comparison of Revolut and Wise (or TransferWise as it was previously known), and what each one has to offer.

Companies are constantly upgrading their features too, so I’d recommend checking the websites yourself to see which travel card is most suited to you!

Here are some other guides that you may find helpful if you’re planning a trip:

Leave a comment

Let us know what you think!